how much federal tax is deducted from a paycheck in ma

Your household income location filing status and number of personal. So the tax year 2022 will start from July 01 2021 to June 30 2022.

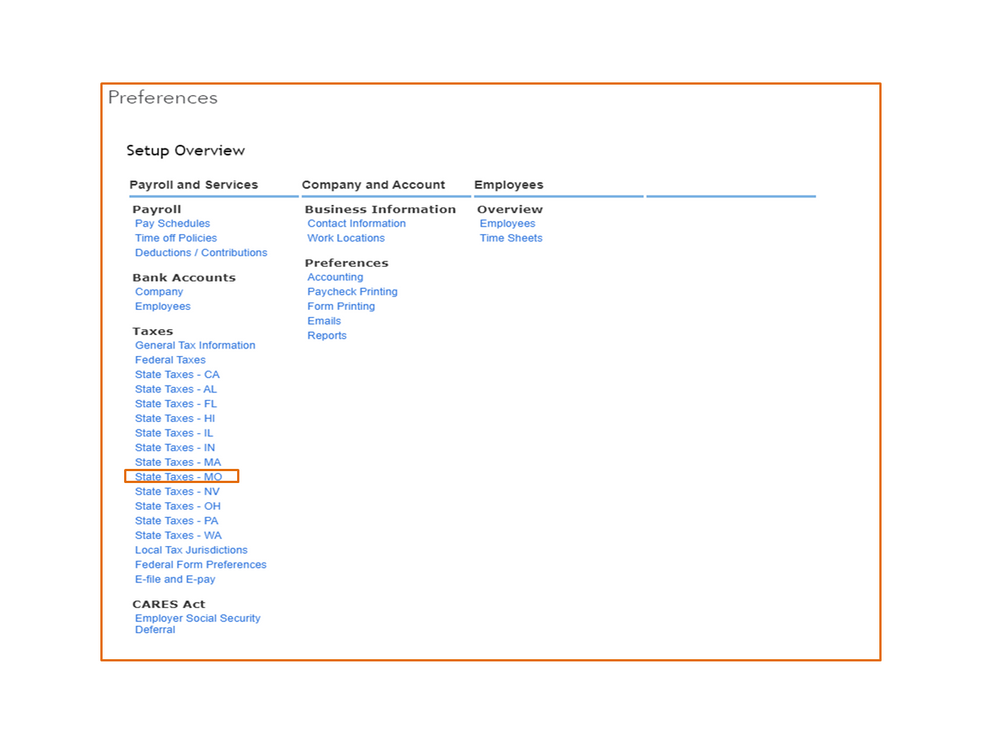

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

. Depending on your filing status you pay federal income tax at a rate of 22 on your. Therefore it will deduct only the state income tax from your paycheck. Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck.

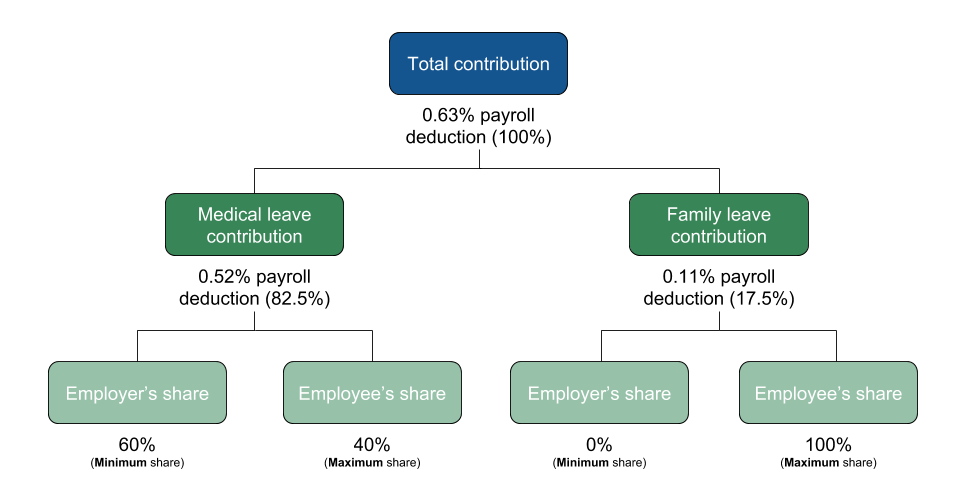

This 153 federal tax is made up of two parts. Social security tax and medicare tax are two federal taxes deducted from your paycheck. Jan 01 2020 when massachusetts income tax withheld is 500 or more by the 7th 15th 22nd and last day of a month pay over within 3 business days after that.

The amount of federal and Massachusetts income tax withheld for the prior year. Even though Floridians pay federal income taxes the Florida constitution prohibits this tax. The information provided by the Paycheck.

For the employee above with 1500 in weekly pay the calculation is 1500 x 765. This is tax withholding. In October 2020 the IRS released the tax brackets for 2021.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Learn about the Claim of Right deduction. In North Carolina The state income tax in North Carolina is 525.

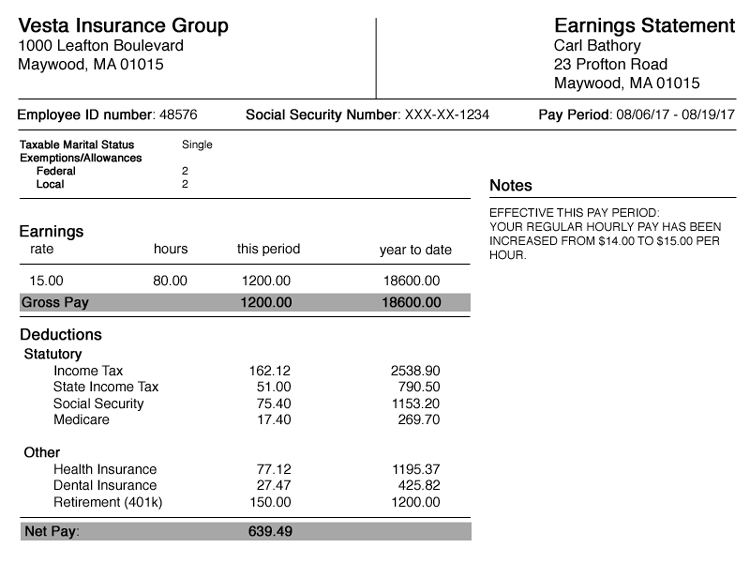

Your average tax rate is 1198 and your. Massachusetts Income Tax Calculator 2021. The total Social Security and Medicare taxes withheld.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The pay slip must list all the deductions from your. Advance Child Tax Credit.

How Is Tax Deducted From Salary. These amounts are paid by both employees and employers. Some states follow the federal tax year some.

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. It is a flat rate that is unchanged. The state tax year is also 12 months but it differs from state to state.

Contacting the Department of. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. You can deduct the most common personal deductions to lower your taxable income.

The standard deduction is the amount taxpayers can subtract from. The standard deduction for married couples filing jointly for tax year 2023 will rise to 27700 up 1800 from tax year 2022. The payer has to deduct an amount of tax based on the rules prescribed by the.

For unemployment insurance information call 617 626-5075. Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a claim of right may deduct.

Massachusetts Announces Contribution Rates Effective July 1 For Paid Family Leave

Workplace Basics Understanding Your Pay Benefits And Paycheck

Check Out The New W 4 Tax Withholding Form Really The New York Times

Payroll Information For Massachusetts State Employees Office Of The Comptroller

Visualizing Taxes Deducted From Your Paycheck In Every State

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Massachusetts Paycheck Calculator Smartasset

New York Hourly Paycheck Calculator Gusto

New Tax Law Take Home Pay Calculator For 75 000 Salary

Does Anyone Work With Small Churches We Have A Small Church And Have Not Paid Unemployment Insurance Or Worker S Comp Insurance How Do I Exempt This From Our Payroll

How Do State And Local Individual Income Taxes Work Tax Policy Center

A Complete Guide To Massachusetts Payroll Taxes

Payroll Tax Calculator For Employers Gusto

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Where Does All Your Money Go Your Paycheck Explained

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

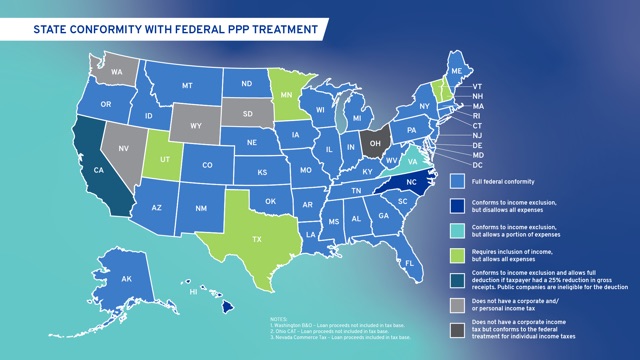

What S The Tax Impact From Payroll Protection Program Loans Virginia Automobile Dealers Association