capital gains tax changes 2021 uk

While we dont know what plans Chancellor Rishi Sunak has in mind one obvious way to potentially raise tax revenues would be to bring the rates of CGT more in-line with Income Tax. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

Tax Preparation Services For Cpas Accounting Firms Businesses

The government will need to strike a balance between raising taxes and stimulating growth but it would not be too surprising if we were to see an increase in the current tax rates on.

. A business owner who pays additional rate tax and who sells their business for a 3m gain could pay almost three times as much tax 135m against 500000 - if CGT is aligned to income tax. This means the value of assets one can cash in without paying tax. Changes to the CGT allowance.

This should and perhaps is likely to be combined with a complete overhaul of capital taxes including Inheritance Tax IHT. The UK capital gains tax rates youll pay. 20 on assets and property.

Tax returns and payments of tax. Integrating the reporting of capital gains which can currently be done in one of three main ways into the new Single Customer Account to ease the administrative burden on those filing returns on disposals. Interestingly the threshold rate of tax for meeting the excluded territories exemption under the UKs controlled foreign company rules would rise from 1425 to 1875.

A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some recommended changes to Capital Gains Tax. Changes to UK CGT are likely to be an attractive option to the Chancellor as he looks at ways. In line with the increase in the main rate the UK Diverted Profits Tax.

As the tax changes come into effect next April we recommend clients review existing structures now so any appropriate steps can be taken before then. 40 on assets and property. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large.

If you own your rental property alongside your husband wife or civil partner you can deduct 24600 from your gain when you sell it. Capital Gains Tax UK changes are coming. This time last year an entrepreneur could pay tax on the first 10m at 10 per cent following a disposal now its 1m at 10 per cent and the rest at 20 per cent.

UK companies pay corporation tax currently 19 on gains made from the disposal of UK property. 20 on assets 28 on property. Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate.

A taxpayer who owns a number of assets can look. 20 for trustees or for personal representatives of someone who has died not including residential property. Certain measures such as the supplemental 4 of Corporation Tax for residential property developers with profits of more than 25m are targeted to specific sectors.

The capital gains tax allowances for the 2020-21 tax year are. The changes in tax rates could be as follows. You will no longer be able to defer payment of Capital Gains Tax via your Self Assessment return and any tax owed must be paid within the.

45 on assets and property. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of the nervousness that the Chancellor would bring CGT more in line with income tax but again this did not materialise. 18 and 28 tax rates for individuals for residential property and carried interest.

12300 for individuals 24600 for couples who are married or in a civil partnership. The report recommended significantly reducing the CGT allowance to make sure more gains are captured by the tax. Extending the reporting and payment deadline for CGT due on disposals of UK residential property to 60 days it is currently 30 days.

10 on assets 18 on property. Non-UK companies pay NRCGT at 20 on gains from the UK real estate. The Capital Gains Tax for the particular year must be paid by the 31 st January following the end of the tax year.

If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers. The OTS report also recognised that many people are avoiding any tax liability by using up their CGT allowance every year. Bringing Capital Gains Tax rates more in line with Income Tax could mean a switch to 20 per cent rates for people on the basic rate 40.

The second part of the report is due in 2021. As announced at Budget the government will introduce legislation in Finance Bill 2021 that maintains the current Capital Gains Tax annual exempt amount at its present level of. 20 on assets 28 on property.

Didyouknow St Matthew The Evangelist Is The Patron Saint Of Accountants As Well As Bookkeepers Tax Collectors Bookk Patron Saints Stock Broker Bookkeeping

Premium Photo Purple Alarm Clock Between The Stack Of Increasing Coins On Wooden Desk Against Blue Background Organizacionnaya Struktura Budilnik Instagram

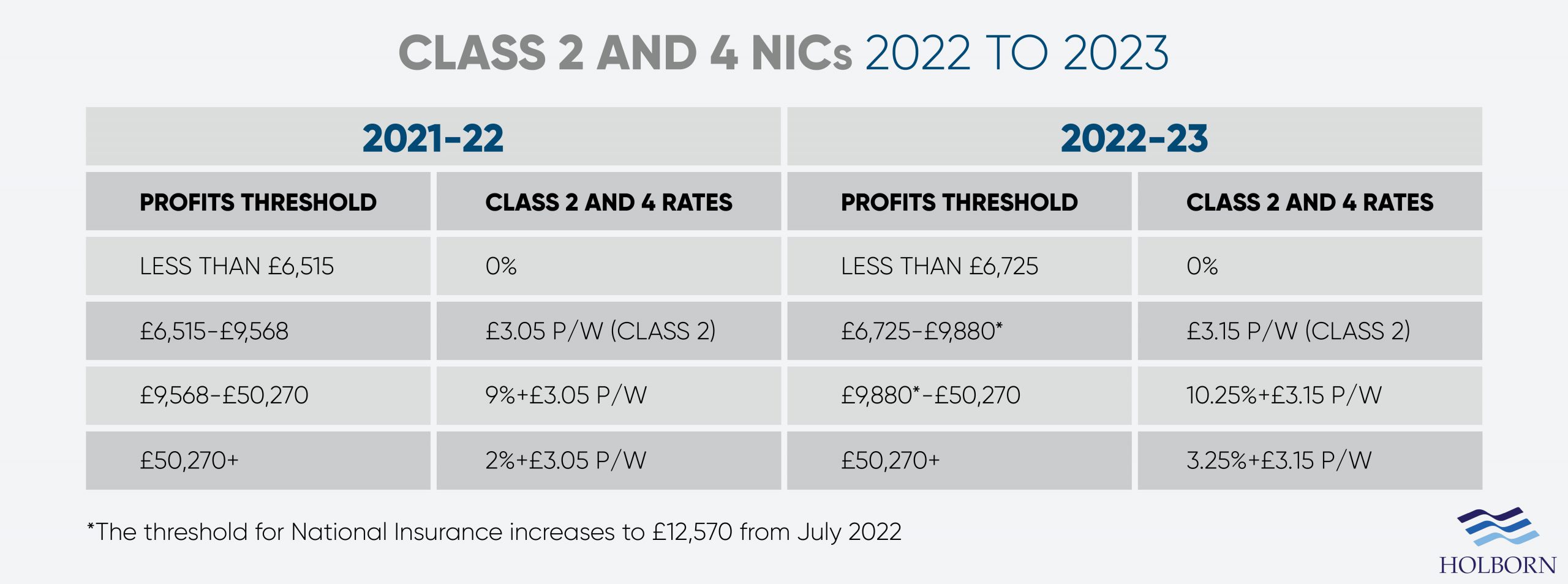

Changes To Uk Tax In 2022 Holborn Assets

Changes To Uk Tax In 2022 Holborn Assets

Dear Joey Mls Policies Change How Does It Affect Me Https Www Floridarealtors Org News Media News Articles 2021 11 Dear Things To Sell Start Up Top Place

How To Tax Capital Without Hurting Investment The Economist

New 26as Check New 26as Changes Before Filing Itr Tax Deducted At Source Cash Credit Card Income Tax Return

Receipt Keeper Receipt Organizer Miles Kimball

Capital Gains Tax Receipts Uk 2022 Statista

Investment Banker Resume Example

Corporation Tax Rate Increase In 2023 From 19 To 25

Publish Your Passions Your Way Whether You D Like To Share Your Knowledge Experiences Or The Latest News Crea Blog Websites Blogging Guide Blogging Mistakes

6 Things You Need To Bear In Mind Before Going Freelance Freelance Health Advice Marketing Jobs

British Consumers Started The Big Splurge Real Time Data Show In 2021 Online Jobs Job Website Job Posting

Budget Summary 2021 Key Points You Need To Know

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What Is Fed Oasdi Ee Tax On My Paycheck Tony Florida Business Tax Deductions Small Business Tax Deductions Tax Deductions

Budget 2021 Is Rishi Sunak Wise To Extend Stamp Duty Holiday For Property Buyers Https Www Thenationalnews Com Business Property Buyers Stamp Duty Overseas